Relinquishment of Right in Land Earmarked for Common Utility Purpose as per Regulatory Requirements Not Taxable as Capital Gain or Business Income: ITAT

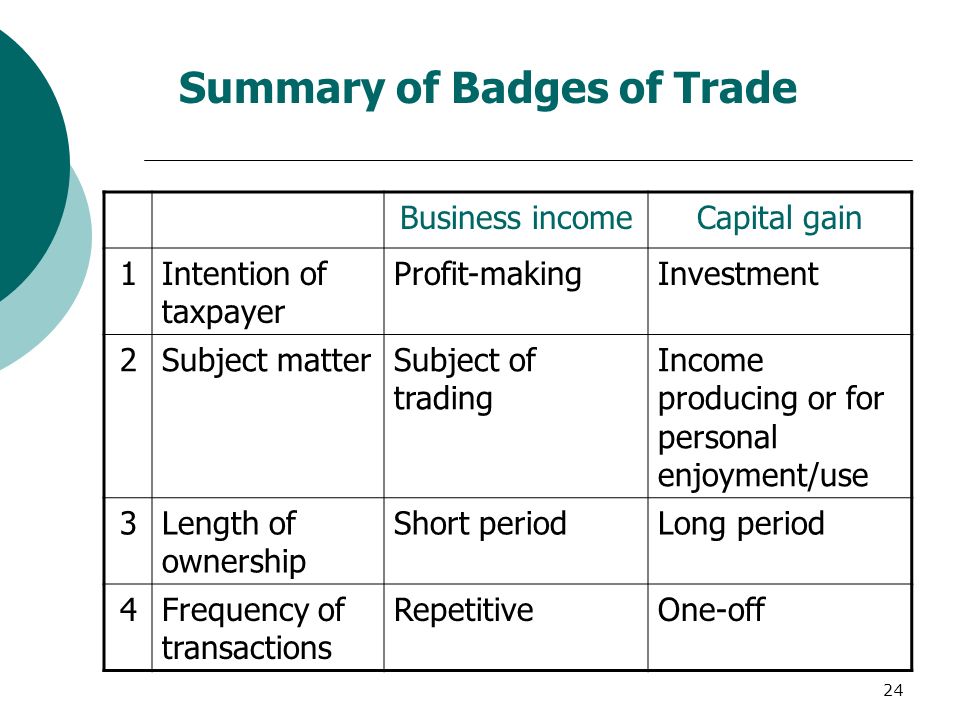

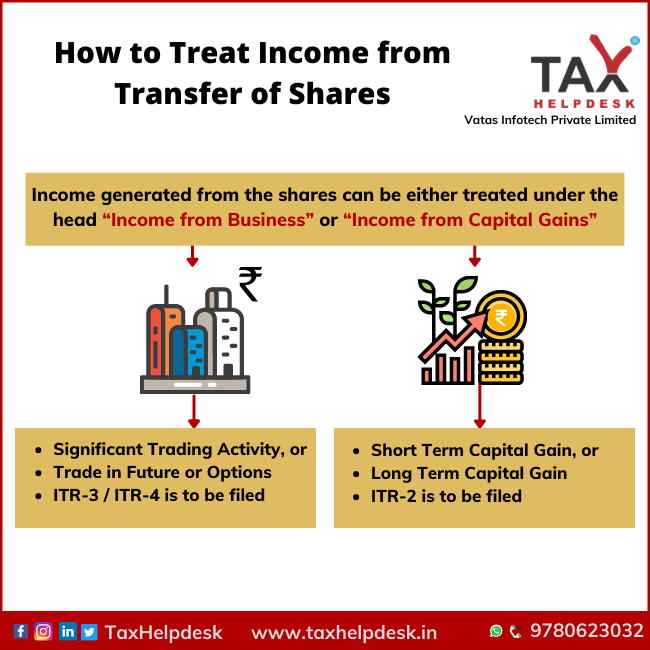

Short term Capital Gain disposed off within a Short Span of time will not justify the gain to be treated as Business Income: ITAT

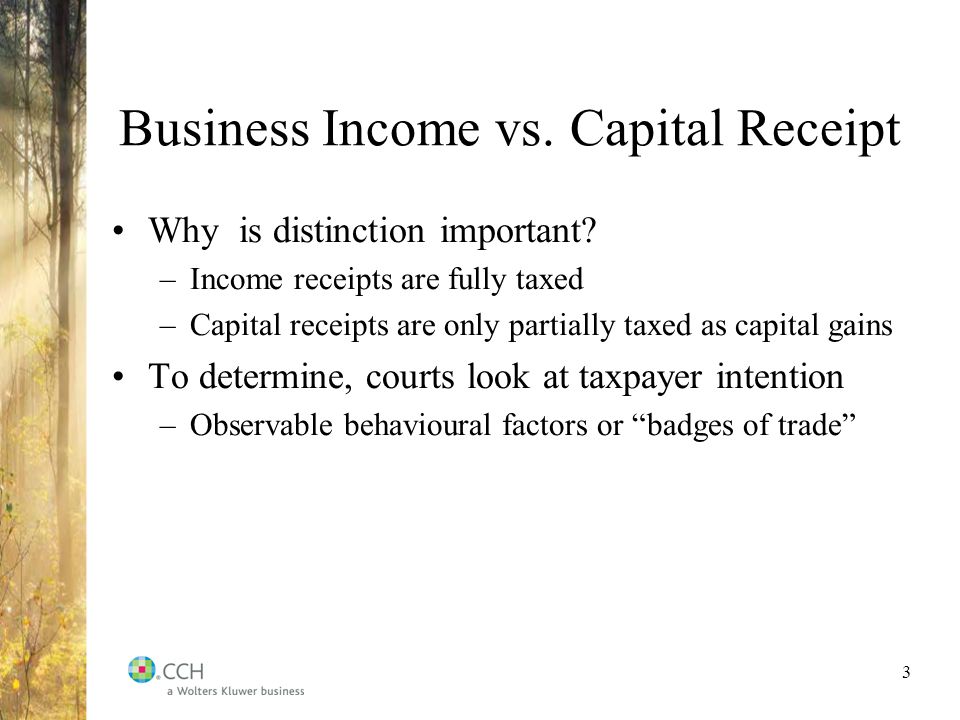

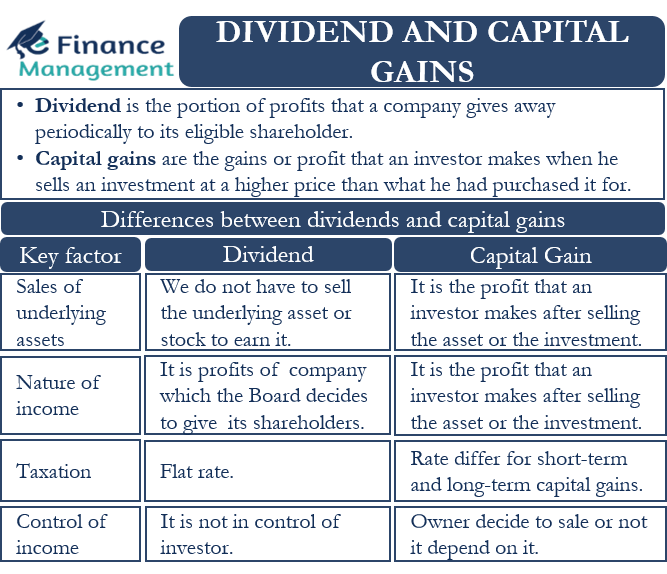

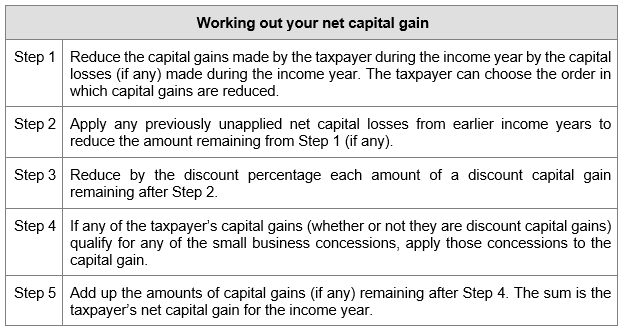

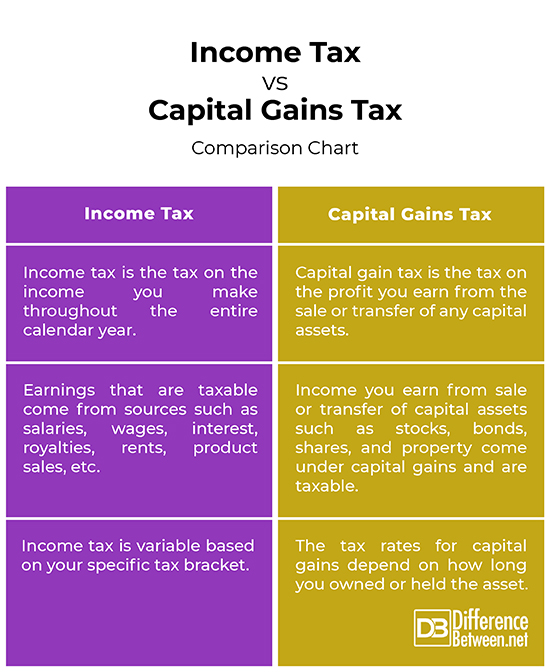

Capital Gains vs. Business Profits – Income Tax News, Judgments, Act, Analysis, Tax Planning, Advisory, E filing of returns, CA Students