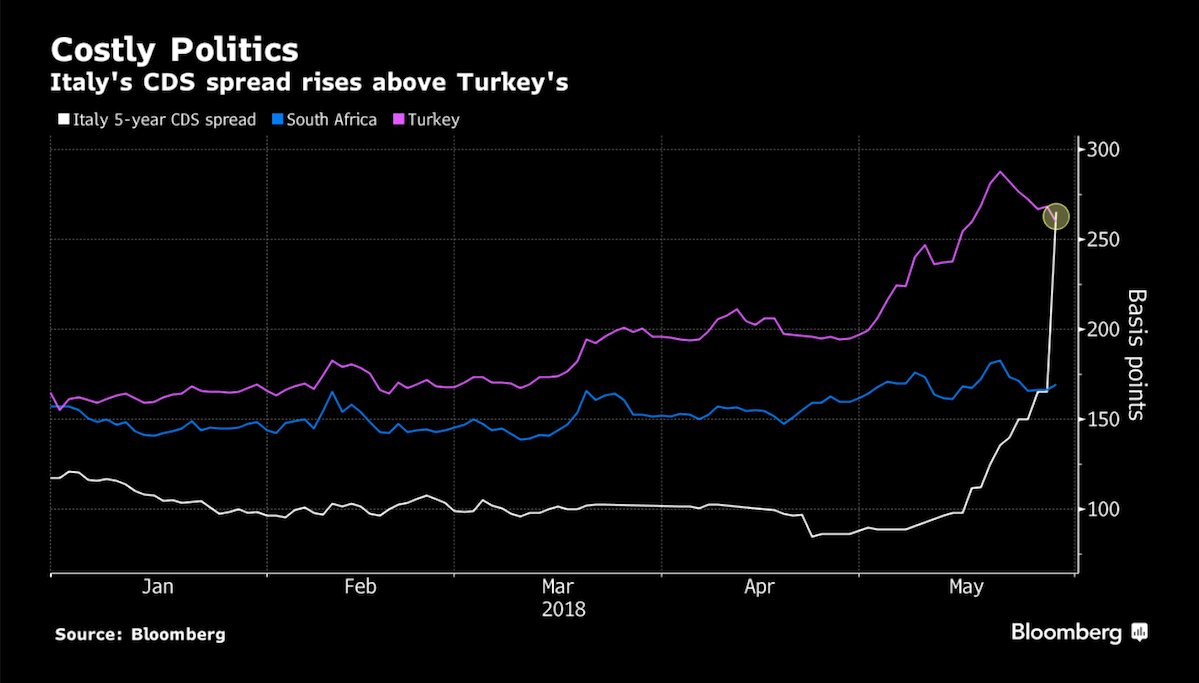

ACEMAXX ANALYTICS on X: "5y CDS for Italy's Gov Bonds; the costs of insuring Italy's debt against default for 5y using CDS soared as high as 276bp, overtaking Turkey, Brazil and South

Historical time-series of some European 5Y sovereign CDS traded in USD... | Download Scientific Diagram

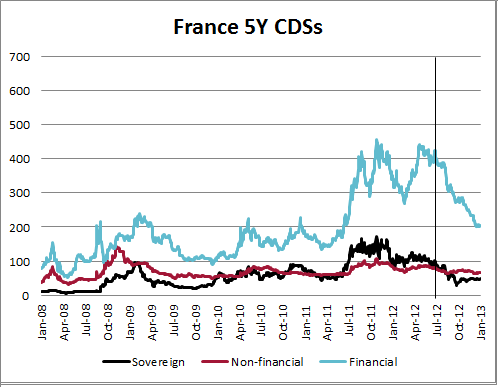

VIX too low given blowout of Italian yields, CDS and dramatic rise of European Itraxx Sub Financial CDS

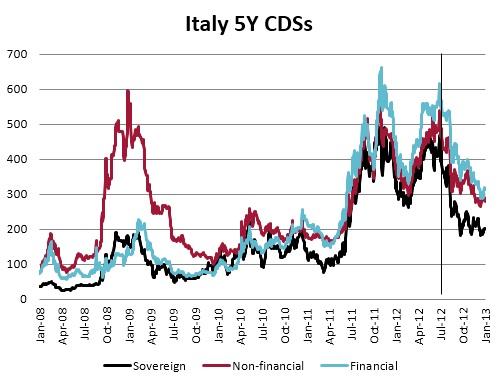

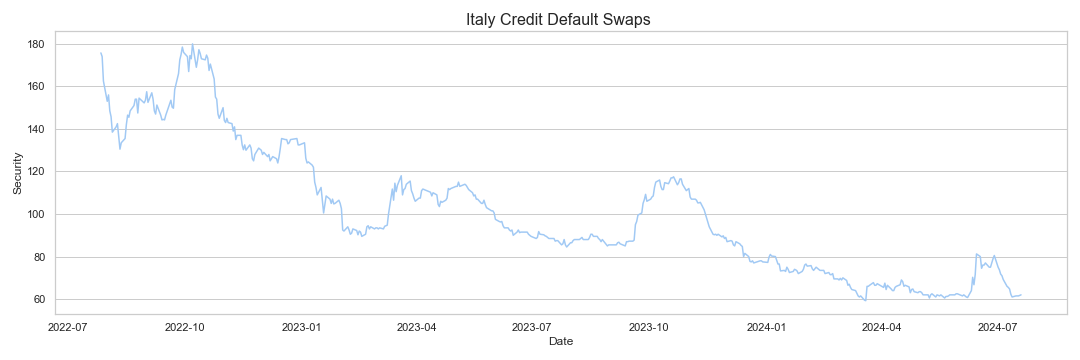

Credit default swap spreads for Italian bank and sovereign bonds (5-year CDS) – Bank of Finland Bulletin

Quanto CDS spreads series: period Q2 2007-Q3 2018. Source: authors'... | Download Scientific Diagram

Holger Zschaepitz on X: "The cost of insuring Credit Suisse bonds against default in near term is approaching a level that typically signals serious investor concerns. 1y CDS for embattled Swiss lender

The evolution of the average 5-year CDS spreads for European Union,... | Download Scientific Diagram

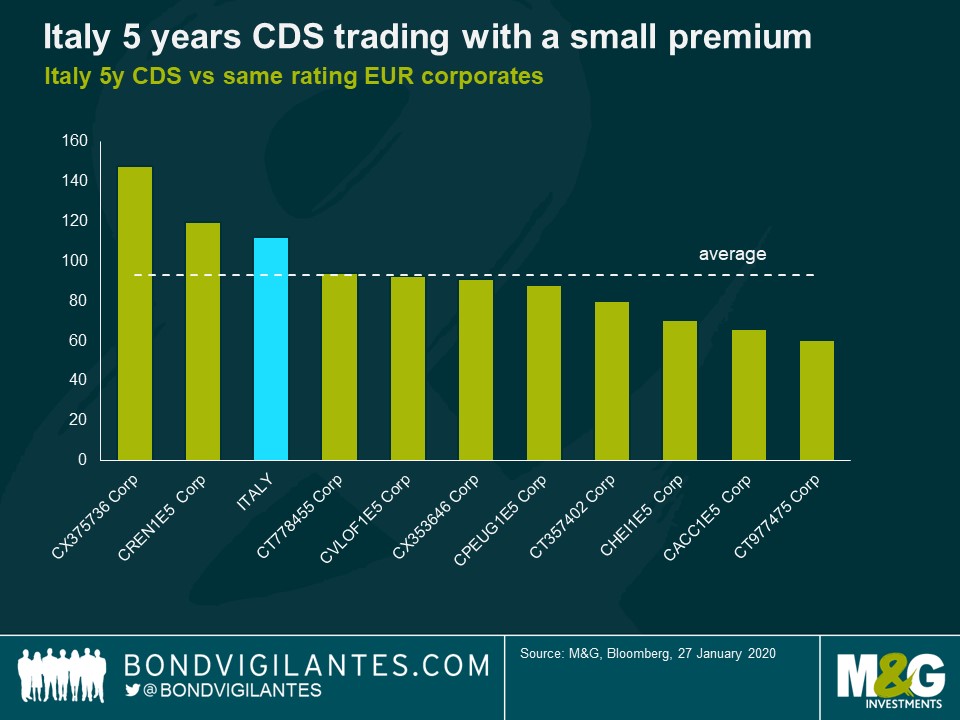

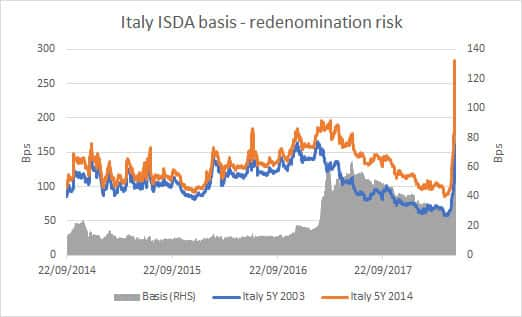

Topic of the week: in defense of Italy Market review: Stress testing equities' duration risk Chart of the week Figure of the

JohannesBorgen on X: "1st chart: 5Y CDS spread. The two curves were basically impossible to distinguish until 2014. Now, Spain (60bps) is closer to France (25bps) than Italy (140bps) https://t.co/XewtULUxdT" / X

![PDF] On the Reliability of a Credit Default Swap Contract during the EMU Debt Crisis | Semantic Scholar PDF] On the Reliability of a Credit Default Swap Contract during the EMU Debt Crisis | Semantic Scholar](https://d3i71xaburhd42.cloudfront.net/3c8f83c2ebde201bf2d3b3184fa4fe77d574ef91/5-Table1-1.png)